Float Security Definition . A floating charge is used as a means to secure. floating stock refers to the number of shares a company has available to trade in the open market. These rates are often tied. The interest rate on these bonds. a floating rate security is one whose interest rate or dividend is influenced by specific market indicators. A security that a broker buys in his/her own name on behalf of a client. a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular debt. To calculate a company's floating stock, subtract its restricted. A floating charge allows a business to borrow even when it does not own a particular asset like premises, which can act as a security.

from bestinterior.com.bd

A security that a broker buys in his/her own name on behalf of a client. a floating rate security is one whose interest rate or dividend is influenced by specific market indicators. A floating charge allows a business to borrow even when it does not own a particular asset like premises, which can act as a security. A floating charge is used as a means to secure. To calculate a company's floating stock, subtract its restricted. a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular debt. The interest rate on these bonds. floating stock refers to the number of shares a company has available to trade in the open market. These rates are often tied.

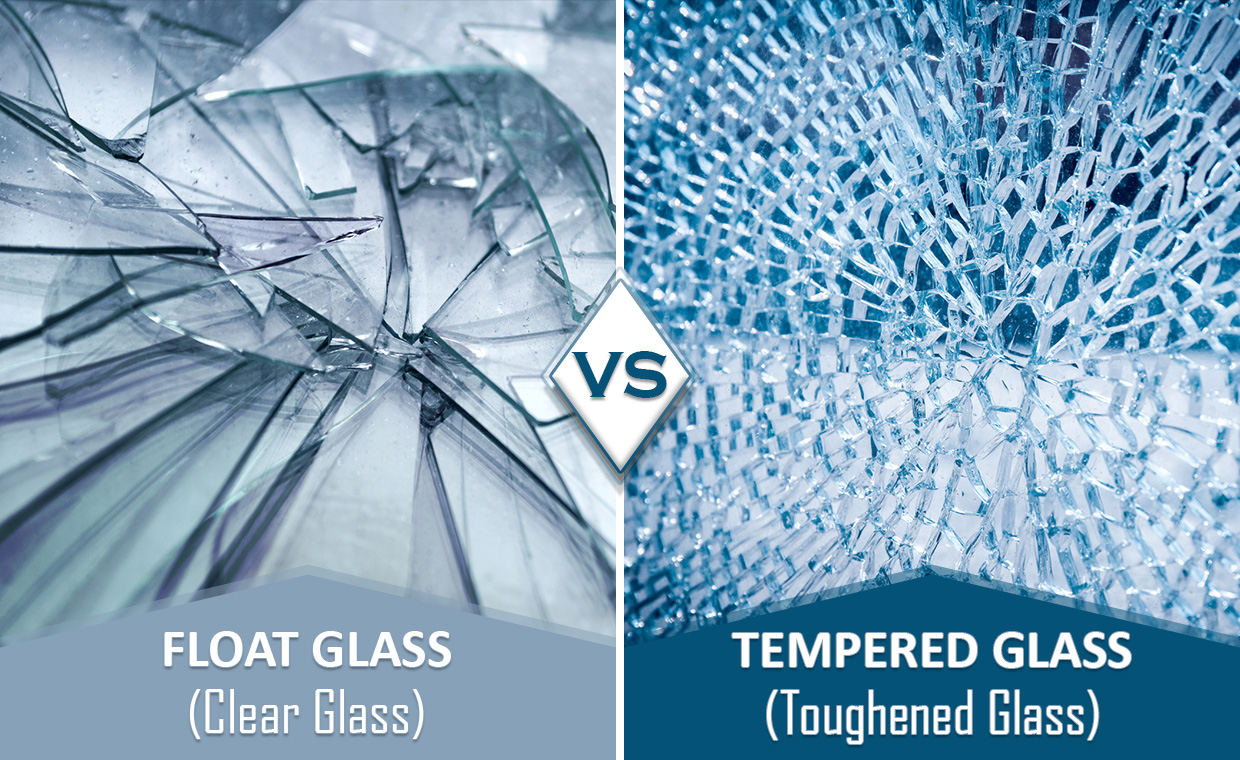

Difference between regular glass and tempered glass

Float Security Definition floating stock refers to the number of shares a company has available to trade in the open market. floating stock refers to the number of shares a company has available to trade in the open market. The interest rate on these bonds. A security that a broker buys in his/her own name on behalf of a client. a floating rate security is one whose interest rate or dividend is influenced by specific market indicators. a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular debt. A floating charge is used as a means to secure. A floating charge allows a business to borrow even when it does not own a particular asset like premises, which can act as a security. These rates are often tied. To calculate a company's floating stock, subtract its restricted.

From www.svgrepo.com

Float Vector SVG Icon SVG Repo Float Security Definition The interest rate on these bonds. These rates are often tied. A floating charge is used as a means to secure. To calculate a company's floating stock, subtract its restricted. A security that a broker buys in his/her own name on behalf of a client. floating stock refers to the number of shares a company has available to trade. Float Security Definition.

From theyachtowner.net

The Float Tube Definition with Some Pictures and Two Videos Float Security Definition A security that a broker buys in his/her own name on behalf of a client. To calculate a company's floating stock, subtract its restricted. floating stock refers to the number of shares a company has available to trade in the open market. a floating charge is a type of security that a creditor undertakes on an entire business’s. Float Security Definition.

From tradeit.gg

CS2 Valor de Float Explicação dos Níveis de Desgaste Guia por Float Security Definition a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular debt. a floating rate security is one whose interest rate or dividend is influenced by specific market indicators. A security that a broker buys in his/her own name on behalf of a client. To calculate a. Float Security Definition.

From luckyexam.com

Example of Floatation and Laws of Floatation LuckyExam Float Security Definition a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular debt. a floating rate security is one whose interest rate or dividend is influenced by specific market indicators. A security that a broker buys in his/her own name on behalf of a client. These rates are. Float Security Definition.

From wirtschaftslexikon.gabler.de

Float • Definition Gabler Wirtschaftslexikon Float Security Definition A floating charge is used as a means to secure. To calculate a company's floating stock, subtract its restricted. A floating charge allows a business to borrow even when it does not own a particular asset like premises, which can act as a security. The interest rate on these bonds. These rates are often tied. a floating charge is. Float Security Definition.

From management-club.com

Calculate float project management Float Security Definition A security that a broker buys in his/her own name on behalf of a client. a floating rate security is one whose interest rate or dividend is influenced by specific market indicators. A floating charge is used as a means to secure. The interest rate on these bonds. To calculate a company's floating stock, subtract its restricted. floating. Float Security Definition.

From www.timothysykes.com

What Is a Stock Float? Definition, Example, and Why Is it Important? Float Security Definition floating stock refers to the number of shares a company has available to trade in the open market. a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular debt. a floating rate security is one whose interest rate or dividend is influenced by specific market. Float Security Definition.

From www.chemicalslearning.com

Float Type Liquid Level Indicators Working Principle and Advantages and Float Security Definition A security that a broker buys in his/her own name on behalf of a client. a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular debt. a floating rate security is one whose interest rate or dividend is influenced by specific market indicators. These rates are. Float Security Definition.

From engineeringlearner.com

Float Valve Definition, Function, Control System, Advantages, Problems Float Security Definition a floating rate security is one whose interest rate or dividend is influenced by specific market indicators. a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular debt. A security that a broker buys in his/her own name on behalf of a client. floating stock. Float Security Definition.

From www.reddit.com

Free float by definition is shares outstanding minus restricted shares Float Security Definition A floating charge allows a business to borrow even when it does not own a particular asset like premises, which can act as a security. The interest rate on these bonds. A floating charge is used as a means to secure. floating stock refers to the number of shares a company has available to trade in the open market.. Float Security Definition.

From www.broadbandsearch.net

Cybersecurity Definition, Importance, and Tips BroadbandSearch Float Security Definition These rates are often tied. A security that a broker buys in his/her own name on behalf of a client. a floating rate security is one whose interest rate or dividend is influenced by specific market indicators. a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a. Float Security Definition.

From sciencenotes.org

Things That Float or Sink in Water Float Security Definition floating stock refers to the number of shares a company has available to trade in the open market. The interest rate on these bonds. A security that a broker buys in his/her own name on behalf of a client. a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect. Float Security Definition.

From www.pesapal.com

Openfloat Security Features Safeguarding Sensiti Pesapal Float Security Definition floating stock refers to the number of shares a company has available to trade in the open market. a floating rate security is one whose interest rate or dividend is influenced by specific market indicators. a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular. Float Security Definition.

From www.dpstar.com.vn

Float Switch Float Sensor Float Level Switch MaltecF MTFH Heavy Float Security Definition a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular debt. A security that a broker buys in his/her own name on behalf of a client. These rates are often tied. The interest rate on these bonds. To calculate a company's floating stock, subtract its restricted. A. Float Security Definition.

From efinancemanagement.com

Collection Float Meaning, Types and How to Reduce it? Float Security Definition a floating rate security is one whose interest rate or dividend is influenced by specific market indicators. A security that a broker buys in his/her own name on behalf of a client. floating stock refers to the number of shares a company has available to trade in the open market. To calculate a company's floating stock, subtract its. Float Security Definition.

From fylader.weebly.com

Float meaning fylader Float Security Definition These rates are often tied. A floating charge allows a business to borrow even when it does not own a particular asset like premises, which can act as a security. The interest rate on these bonds. a floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular debt.. Float Security Definition.

From www.projectcubicle.com

Total Float Versus Free Float in Scheduling Float Security Definition To calculate a company's floating stock, subtract its restricted. A floating charge allows a business to borrow even when it does not own a particular asset like premises, which can act as a security. floating stock refers to the number of shares a company has available to trade in the open market. The interest rate on these bonds. . Float Security Definition.

From www.dumblittleman.com

What is Stock Float Definition, How To Calculate and Example • Dumb Float Security Definition A security that a broker buys in his/her own name on behalf of a client. A floating charge allows a business to borrow even when it does not own a particular asset like premises, which can act as a security. These rates are often tied. To calculate a company's floating stock, subtract its restricted. floating stock refers to the. Float Security Definition.